b&o tax wv

The city is currently in the process of developing an online method for paying your BO taxes that should be available soon. Tax Return Form Businesses choose which way to submit Tax returns.

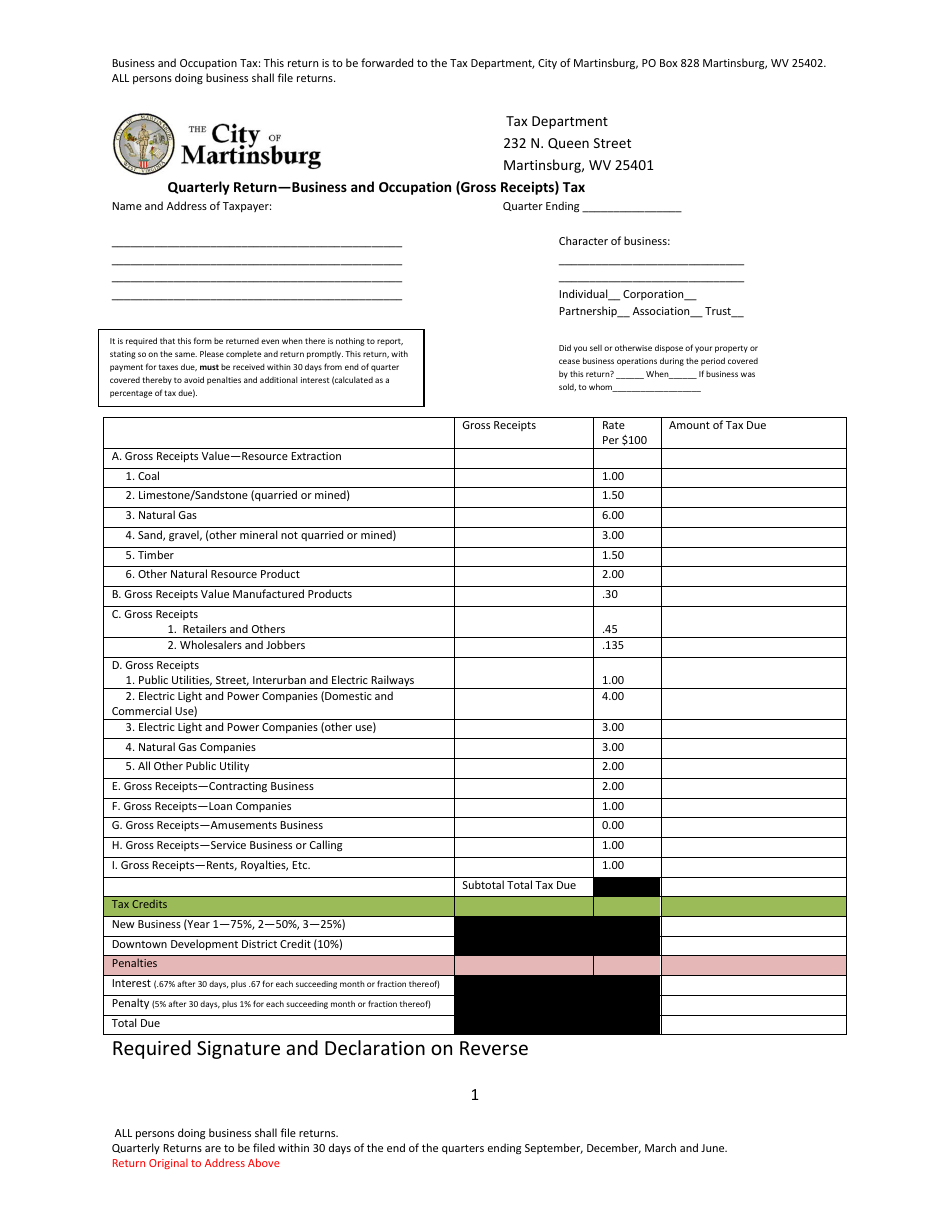

West Virginia Quarterly Return Business And Occupation Gross Receipts Tax Download Fillable Pdf Templateroller

Failure to complete this form in its entirety andor enclose your remittance will result.

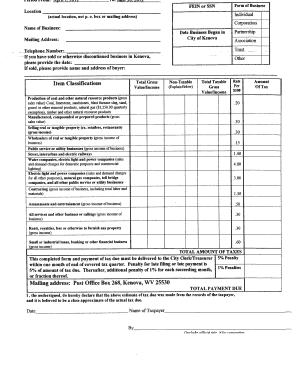

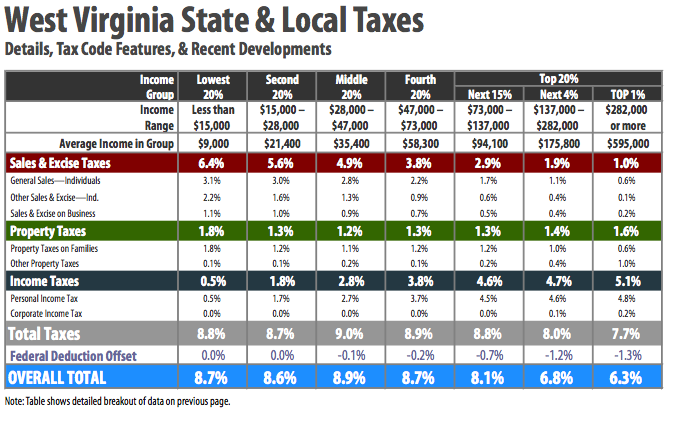

. Of these 117 impose a business and occupation tax in some form and the other 117 municipalities do not impose a business and occupation tax. 10000 in gross taxable income times a service rate 5 or 005 equals a BO tax of 50. The appropriate BO tax classification depends on the nature of the business activity.

No deduction is allowed for labor materials taxes or other costs of doing business. Charleston West Virginia is a great place to live work and play. East Charleston WV 25301 3043488000.

City of Weirton 200 Municipal Plaza Weirton WV 26062 Phone. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. It applies to the gross income of the business.

New and expanding businesses locating in the Business and Technology Center will be able to get 100000 in tax. Business Occupation Tax. Filing periods end on march 31 june 30 september 30 and december 31 unless other arrangements and permission has been granted by the finance division.

Our City is always growing so use the information here to assist you. This tax is required to be reported quarterly and is due on or before 30 days from the quarter ending. Box 5097 Vienna WV 26105-5097 Phone.

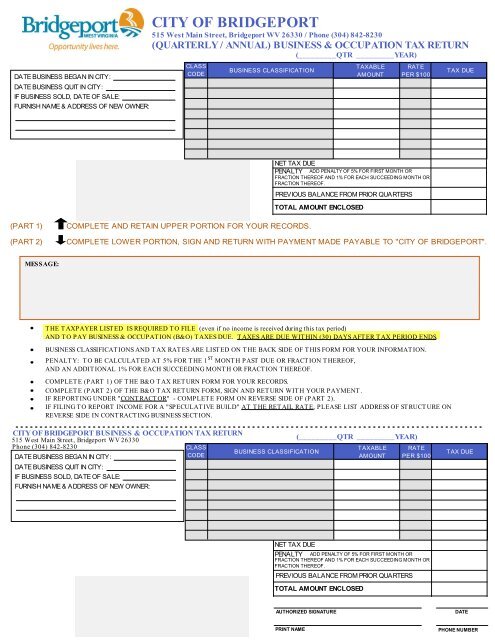

Determine your taxes due by multiplying the rate by the taxable income. Business Occupation Tax. Businesses engaged in multiple.

The main revenue source for West Virginia cities is the business and occupation tax generated by any commercial activity locate within the City limits. 323 or email the BO Tax Office. Either by downloading a PDF and filling it out by hand or downloading the new B and O Tax Worksheet in Microsoft Excel to keep for your own records.

The tax is due and payable each quarter. Tax Rates Contact Us Business Occupation Tax Email Business and Occupation Tax Department Physical Address 200 Jackson Street 3rd Floor. BOT-300G Tax for Gas Storage.

Martinsburg WV 25401 304-264-2131 Ext. Code 8-13C-4 and 5 to impose municipal sales and use taxes at a rate not to exceed one percent. 1 Wall Street Ravenswood West Virginia 26164.

PO Box 2514 Beckley WV 25802. Schedule I-EPP Industrial Expansion or Revitalization Credit. Return by the due date to avoid delinquent notices and tax assessments.

The West Virginia Municipal Business and Occupation Tax BO Tax is an annual privilege tax imposed on all persons and entities doing business in West Virginia municipalities that impose the tax. Information on BO Taxes for Charleston WV. Gross income or gross proceeds of sales derived from sales within West Virginia which is not taxed or taxable by any other municipality are included in the measure of Charleston BO Tax if the sales are either directed from a city location or if the taxpayers.

For assistance call 3046965540 press option 4 for the Finance Division BO TAXES WAIVED FOR RETAIL RESTAURANT AND OTHER TAX CLASSIFICATION. Activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City of Charleston. 332 Fax 304 295-4955 Please Provide Email Please Provide Phone Number NAME.

Until that time businesses may pay their taxes by visiting city hall between the weekday hours of 9AM and 5PM or mailing the payment to. The following general principles determine tax liability under the municipal BO Tax. BO Taxes Business and Occupation BO taxes are due twice a year January and July.

The BO tax is a gross receipts tax assessed against an entity for conducting business in Washington. Tax Information and Assistance. The Citys B O Tax is based on the gross income gross receipts of each business.

The City of Clarksburg has business and occupation tax charged on gross revenues of every entity conducting business within the corporate limits of this municipality. Mayor Williams waived Retail Restaurant Others BO Tax Classification 5 on September 13 2021. All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City of Charleston.

BOT-300F Tax Return for Synthetic Fuels. Certain occupations and business activities are classified and the classifications are significant. Government City Departments Finance Department.

The rate per 10000 of gross revenue varies by business classification. The amount of tax is determined by the. If no reportable activity 000 gross sales occurred during.

Bo tax wv. B O Tax There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. Business as used in the ordinance setting up this tax structure includes all activities.

Contracting class instructions are listed below 3. 247 304-264-2136 Fax Email. Municipalities that do not impose a business and occupation tax are authorized in W.

409 S Kanawha Street. Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. New and expanding businesses in the CBD Glen Elk Number 1 Glen Elk Number 2 and Montpelier areas of the City will be able to get B and O Tax credits for up to a maximum of 50000 over the three year program.

Determine your Business Classifications and corresponding rates from the tax table. BO Reporting Credits Sch G Anniversary BO Reporting Credits Sch H Residential Development For questions or concerns please contact the BO Tax Office at 304-366-6212 ext. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be.

Business Amp Occupation Tax Return Rates City Of Bridgeport

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

Kenova Wv B O Tax Form Fill Online Printable Fillable Blank Pdffiller

City Of Logan West Virginia New B O Tax Forms And Business License Update Forms Are Being Sent Out Beginning August 1st With The Revised Rates All Fees Will Be Due October

Business Occupation Tax Clarksburg Wv

Is The Proposed Cut To The B O Tax In W Va The Start Of Its Elimination Wtov

City Of Buckhannon B O Tax Forms

West Virginia Firefighters Share Concerns About Proposal To Slash B O Taxes Wowk

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

Wv Cities Worry About B O Tax Cuts

/cloudfront-us-east-1.images.arcpublishing.com/gray/5TPE3UYTCRB4TE4XNTL57XBUE4.JPG)

W Va Cities Receive Budget Cut Under Proposed Bill In Legislature Mayors Speaking Out Against It

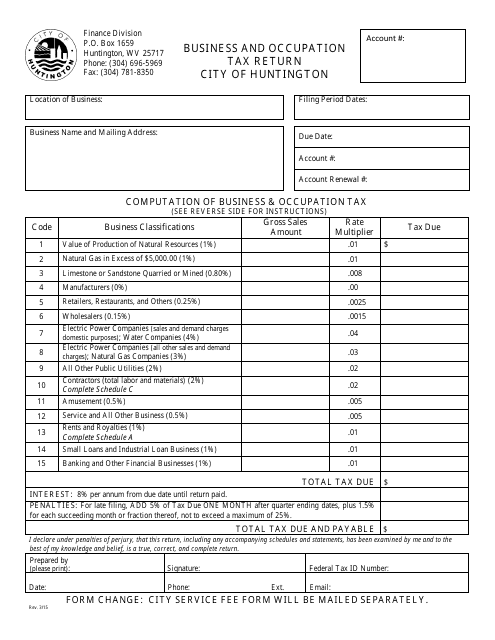

City Of Huntington West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

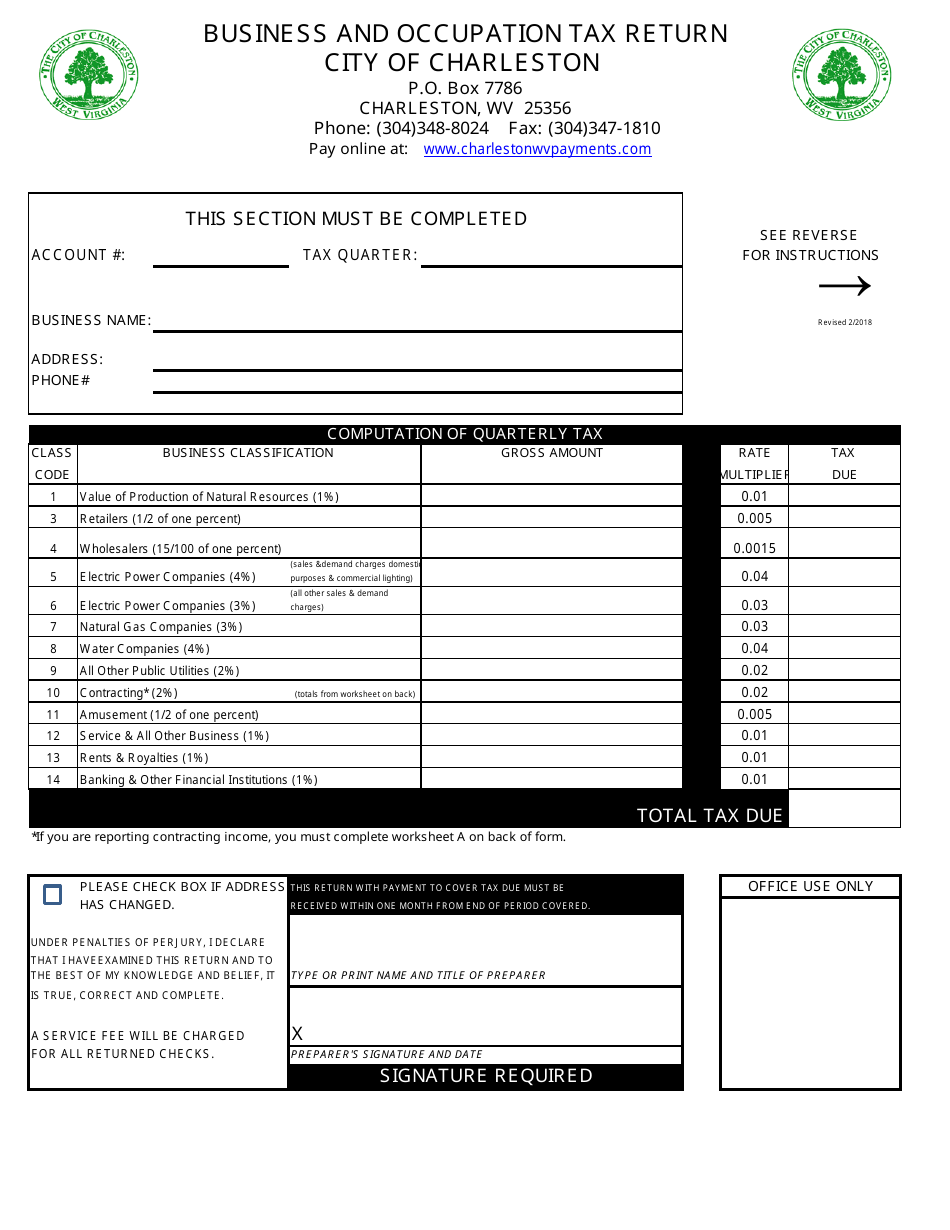

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

Wv Gross Sales Tax Fill Out Tax Template Online Us Legal Forms